[ This is a content summary only. Visit our website http://ift.tt/1b4YgHQ for full links, other content, and more! ]

by Web Desk via Digital Information World

"Mr Branding" is a blog based on RSS for everything related to website branding and website design, it collects its posts from many sites in order to facilitate the updating to the latest technology.

To suggest any source, please contact me: Taha.baba@consultant.com

This article was originally published on Blockchain Review. Thank you for supporting the partners who make SitePoint possible.

What's the difference between a private, public, and consortium blockchain? Understanding this is important.

As financial institutions begin to explore the possibilities of blockchain technology, they are coming up with systems that complement their existing business models. A private or a consortium blockchain platform, as opposed to the public platform that Bitcoin uses, will allow them to retain control and privacy while still cutting down their costs and transaction speeds.

In fact, this private system will have lower costs and faster speeds than a public blockchain platform can offer.

Blockchain purists aren't impressed. A private platform effectively kills their favorite part of this nascent technology: decentralization.

They see the advent of private blockchain systems as little more than a sneaky attempt by big banks to retain their control of financial markets.

In a way, they're correct.

Though the evil plot narrative is a bit much. If big banks can utilize a form of blockchain technology that revolutionizes finance, and if they are willing and able to pass these benefits onto their customers, then it is hardly an evil plot.

It is just good business.

Vitalik Buterin said it best:

The idea that there is "one true way" to be blockchaining is completely wrong headed, and both categories have their own advantages and disadvantages. [1]

Let's take a deeper look at what these might be.

A blockchain was designed to securely cut out the middleman in any exchange of asset scenario. It does this by setting up a block of peer-to-peer transactions. Each transaction is verified and synced with every node affiliated with the blockchain before it is written to the system.

Until this has occurred, the next transaction cannot move forward. Anyone with a computer and internet connection can set up as a node that is then synced with the entire blockchain history.

While this redundancy makes public blockchain extremely secure, it also makes it slow and wasteful.

The electricity needed to run each transaction is astronomical and increases with every additional node. The benefit is every transaction is public and users can maintain anonymity.

A public blockchain is most appropriate when a network needs to be decentralized.

It is also great if full transparency of the ledger or individual anonymity are desired benefits. Costs are higher and speeds are slower than on a private chain, but still faster and less expensive than the accounting systems and methods used today.

This is a good trade-off for a cryptocurrency like Bitcoin.

Security is key to their users, a decentralized network is at the heart of the project and their competitors in the finance industry are still significantly more expensive and slower than a public blockchain network despite its slowness when compared to a private blockchain.

Private blockchain lets the middleman back in, to a certain extent. I believe the saying goes: better the devil you know, than the devil you don't know.

The company writes and verifies each transaction. This allows for much greater efficiency and transactions on a private blockchain will be completed significantly faster. Though it does not offer the same decentralized security as its public counterpart, trusting a business to run a blockchain is no more dangerous than trusting it to run a company without blockchain.

The company can also choose who has read access to their blockchain's transactions, allowing for greater privacy than a public blockchain.

A private blockchain is appropriate to more traditional business and governance models, but that isn't a bad thing. Just because it is unlikely to revolutionize our world, doesn't mean it can't play a role in making the world better.

Competition is key to developing the most useful products. Traditional financial institutions have long held a monopoly — technically, an oligopoly — over the industry.

Their outdated products and services are a direct result of this power.

Using a privately run version of blockchain technology can bring these organization into the 21st century.

A number of our governance institutions are old and outdated as well.

Like finance, our government is not subject to competition. Adoption and integration will likely be slower in this sector, but if and when blockchain technologies are adopted they will cut billions of dollars of behind the scenes spending.

Imagine a truly secure online voting system. No more poll workers, voting booths, paper ballots, paid counters or organizers with cushy salaries. What's more, the barriers to voting will be greatly reduced and we will likely see an increase in turnout.

This could be accomplished with a public design, but most governments are unlikely to decentralize control and security, so a vetted private system greatly increases the chance of adoption.

Consortium blockchain is partly private. There has been some confusion about how this differs from a fully private system. Vitalik Buterin provides a pretty straightforward definition:

Continue reading %How Does the Blockchain Work? Pt. 4%

This article was originally published on Blockchain Review. Thank you for supporting the partners who make SitePoint possible.

What is consensus and why does it matter?

The world of Bitcoin and underlying technologies of distributed ledger and blockchain are experiencing rapid change and growth.

As low-trust digital systems gain adherents and differing use cases, developers are creating new variant blockchains to deal with the inevitable fragmentation between public, consortium and private blockchain technologies.

Let's note the differences between public, consortium and private blockchains.

Public — Fully decentralized and uncontrolled networks with no access permission required — anyone can participate in the consensus process to determine which transaction blocks are added. There is usually little or no pre-existing trust between participants in a public blockchain.

Consortium — The consensus process for new transaction blocks is controlled by a fixed set of nodes, such as a group of financial institutions where pre-existing trust is high.

Private — Access permissions are tightly controlled, with rights to read or modify the blockchain restricted to certain users. Permissions to read the blockchain may be restricted or public. [1]

There is usually some degree of pre-existing trust between at least some private blockchain participants.

The degree of pre-existing trust that an organization requires, as well as necessary control over participant permissions, will determine what type of blockchain to use.

Different blockchain solutions have advantages and disadvantages. Take for example the difference between how transactions are validated within each type of blockchain:

Proof of Work (PoW): About "mining" transactions utilizing a resource-intensive hashing process, which (a) confirms transactions between network participants and (b) writes the confirmed transactions into the blockchain ledger as a new block.

The accepted new block is proof that the work was done, so the miner may receive a 25 BTC (Bitcoins) payment for successfully completing the work. The problem with PoW is that it is resource-intensive and creates a centralizing tendency among miners based on computer resource capability.

Proof of Stake (PoS): About "validating" blocks created by miners and requires users to prove ownership of their "stake" [2]. Validation introduces a randomness into the process, making the establishment of a validation monopoly more difficult, thereby enhancing network security.

One problem with PoS is the "nothing at stake" issue, where miners have nothing to lose in voting for different blockchain histories, preventing a consensus from being created. There are several attempts to solve this problem underway.

Additional developments in this area hope to combine PoW with PoS to create hybrid blockchains with the highest security and lowest resource requirements.

To that end, some developers are focused on enhancing network security through 'consensus without mining.' [3]

Tendermint co-founder Jae Kwon has published a paper describing his firm's concept and approach in this regard.

Existing Proof of Work and Proof of Stake protocols have various problems, such as requiring huge outlays of energy usage and increasing centralization (PoW) or participants having nothing at stake (PoS) possibly contributing to consensus disruption on mined blocks.

Kwon's solution is twofold and does not require Proof of Work mining:

The algorithm is based on a modified version of the DLS protocol and is resilient up to ⅓ of Byzantine participants.

Kwon and his team at Tendermint hope to bring speed, simplicity and security to blockchain app development.

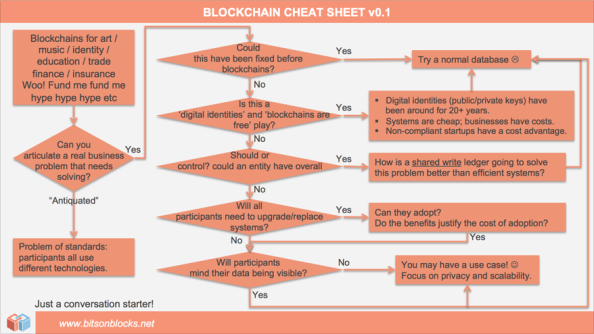

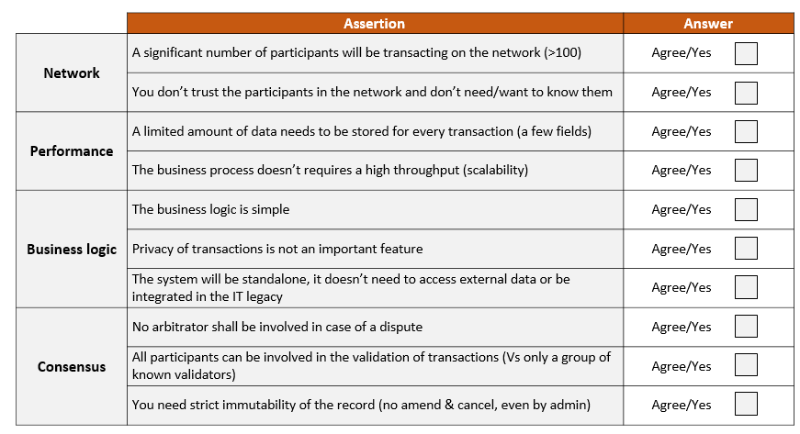

So, how does one decide on what type of blockchain to use and their relevancy for your company use case? [4]

Below are a few examples of different types of blockchains, depending on the organization's greatest prioritized need:

One consideration is confidentiality. For example, in the case of a public financial blockchain, all the transactions appear on the ledgers of each participant. So while the identities of the transacting parties are not known, the transactions themselves are public.

Some companies are developing 'supporting' blockchains to avoid this problem, by storing or notarizing the contracts in encrypted form, and performing some basic duplicate detection. Each company would store the transaction data in their own database, but use the blockchain for limited memorialization purposes.

A second consideration is whether you need provenance tracking. Existing supply chains are rife with counterfeit and theft problems. A blockchain that collectively belongs to the supply chain participants can reduce or eliminate breaks in the chain as well as secure the integrity of the database tracking the supply chain.

A third example is the need for record-keeping between organizations, such as legal or accounting communications. A blockchain that timestamps and provides proof of origin for information submitted to a case archive would provide a way for multiple organizations to jointly manage the archive while keeping it secure from individual attempts to corrupt it.

Blockchains fundamentally operate on the basis of how consensus is agreed upon for each transaction added to the ledger.

What are the benefits of each type of consensus mechanism, and in which situation are they best utilized?

Proof of Work — Miners have a financial incentive to process as many transactions as quickly as possible. PoW is best utilized by high-throughput requirement systems.

Proof of Stake — Transaction Validators receive rewards in proportion to the amount of their "stake" in the network. This arguably improves network security by discouraging duplicitous attacks. PoS is best used by computing power constrained organizations.

Delegated Proof of Stake [5] — Network parameters are decided upon by elected delegates or representatives. If you value a "democratized" blockchain with reduced regulatory interference, this version is for you.

PAXOS — An academic and complicated protocol centered around multiple distributed machines reaching agreement on a single value. This protocol has been difficult to implement in real-world conditions.

RAFT — Similar to PAXOS in performance and fault tolerance except that it is "decomposed into relatively independent subproblems", making it easier to understand and utilize.

Round Robin — Utilizing a randomized approach, the round robin protocol requires each block to be digitally signed by the block-adder, which may be a defined set of participants. This is more suited to a private blockchain network where participants are known to each other.

Federated Consensus — Federated consensus is where each participant knows all of the other participants, and where small sets of parties who trust each other agree on each transaction and over time the transaction is deemed valid. Suitable for systems where decentralized control is not an imperative.

Proprietary Distributed Ledger — A PDL is one where the ledger is controlled, or proprietary, to one central entity or consortium. The benefits of this protocol is that there is already a high degree of pre-existing trust between the network participants and agreed-upon security measures. Suitable for a consortium or group of trading partners, such as supply chains.

PBFT — In a PBFT system, each node publishes a public key and messages are signed by each node, and after enough identical responses the transaction is deemed valid. PBFT is better suited for digital assets which require low latency due to high transaction volume but do not need large throughput.

N2N — Node to node (N2N) systems are characterized by encrypted transactions where only the parties involved in a transaction have access to the data. Third parties such as regulators may have opt-in privileges. Suitable for use cases where a high degree of transaction confidentiality is required.

The above list represents the current major consensus mechanisms in operation or from research.

Due to the initial visibility of Bitcoin, the financial services industry has been early in researching the possible uses of consensus mechanisms to streamline operations, reduce costs and eliminate fraudulent activity.

Continue reading %How Does the Blockchain Work? Pt. 3%

This article was originally published on Blockchain Review. Thank you for supporting the partners who make SitePoint possible. The top five things that you need to know. The talk about Blockchain technology seems ubiquitous. But what exactly is a blockchain? More specifically, what are the blockchain essentials that you should really know? Let’s dive in […]

Continue reading %How Does the Blockchain Work? Pt. 2%

This article was originally published on Blockchain Review. Thank you for supporting the partners who make SitePoint possible.

If you really want to get into the blockchain and cryptocurrency world, I would highly recommend that you start your journey by reading these two white papers: Bitcoin: A Peer-to-Peer Electronic Cash System and Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform -- and then read them again, and again.

If you're like many people asking questions such as: "I have an idea and I want to know if my project is suitable for a blockchain," read those two papers, plus How to hire a blockchain developer.

I wish you all the best on your journey. Let's take a look at the blockchain specifically.

Blockchain is a hot topic around the world these days, yet for many, the technology remains an elusive concept. But it doesn't have to -- the concept is simple once you get your head around the architecture and theory of basic cryptoeconomics. When you do have your "a-ha" moment, the world will never seem the same to you again.

This blockchain basics guide is designed to deliver a clear, non-technical introduction to one of the most transformational and misunderstood technologies of our time. If you want to know what blockchain technology is, how it works, and its potential impacts, without all the technical lingo, then this post is for you.

Historically, when it comes to transacting money or anything of value, people and businesses have relied heavily on intermediaries like banks and governments to ensure trust and certainty. [1] Middlemen perform a range of important tasks that help build trust into the transactional process like authentication and record keeping. [2]

The need for intermediaries is especially acute when making a digital transaction. Because digital assets like money, stocks and intellectual property are essentially files, they are incredibly easy to reproduce. This creates what's known as the double spending problem (the act of spending the same unit of value more than once), which until now has prevented the peer-to-peer transfer of digital assets. [3]

But what if there was a way of conducting digital transactions without a third party intermediary? Well, a new technology exists today that makes this possible. But before we dive into the mechanics of this revolutionary technology, it's important to provide a little context.

Bitcoin first appeared in a 2008 white paper authored by a person, or persons, using the pseudonym Satoshi Nakamoto. The white paper detailed an innovative peer-to-peer electronic cash system called Bitcoin that enabled online payments to be transferred directly, without an intermediary. [4]

How the Blockchain Transfers Value via techliberation.com

While the proposed bitcoin payment system was exciting and innovative, it was the mechanics of how it worked that was truly revolutionary. Shortly after the white paper's release, it became evident that the main technical innovation was not the digital currency itself, but the technology that lay behind it, known today as blockchain.

Although commonly associated with Bitcoin, blockchain technology has many other applications. Bitcoin is merely the first and most well-known implementation. In fact, Bitcoin is only one of about seven hundred applications that use the blockchain concept today. [5]

[Blockchain] is to Bitcoin, what the internet is to email. A big electronic system, on top of which you can build applications. Currency is just one. — Sally Davies, FT Technology Reporter [6]

One example of the evolution and broad application of blockchain, beyond digital currency, is the development of the Ethereum public blockchain, which provides a way to execute peer-to-peer contracts. [7]

Simply put, a blockchain is a type of distributed ledger or decentralized database that keeps continuously updated digital records of who owns what. Rather than having a central administrator like a traditional database, (think banks, governments and accountants), a distributed ledger has a network of replicated databases, synchronized via the internet and visible to anyone within the network. [8]

Blockchain networks can be private with restricted membership similar to an intranet, or public, like the Internet, accessible to any person in the world. [9], [10]

When a digital transaction is carried out, it is grouped together in a cryptographically protected block with other transactions that have occurred in the last 10 minutes and been sent out to the entire network. Miners (members in the network with high levels of computing power) then compete to validate the transactions by solving complex coded problems. [11] The first miner to solve the problems and validate the block receives a reward. In the Bitcoin blockchain network, for example, a miner would receive Bitcoins.

Continue reading %How Does the Blockchain Work? Pt. 1%

EasyTimer.js is a simple timer/chronometer/countdown library compatible with AMD and NodeJS.

EasyTimer.js released under the MIT license

|