Creating jobs is generally a good thing for a nation, but in spite of the fact that this is the case, the present economic climate has necessitated the Fed to cool things down. Reducing the number of jobs in the economy is necessary because of the fact that this is the sort of thing that could potentially end up reducing the amount of money in the system.

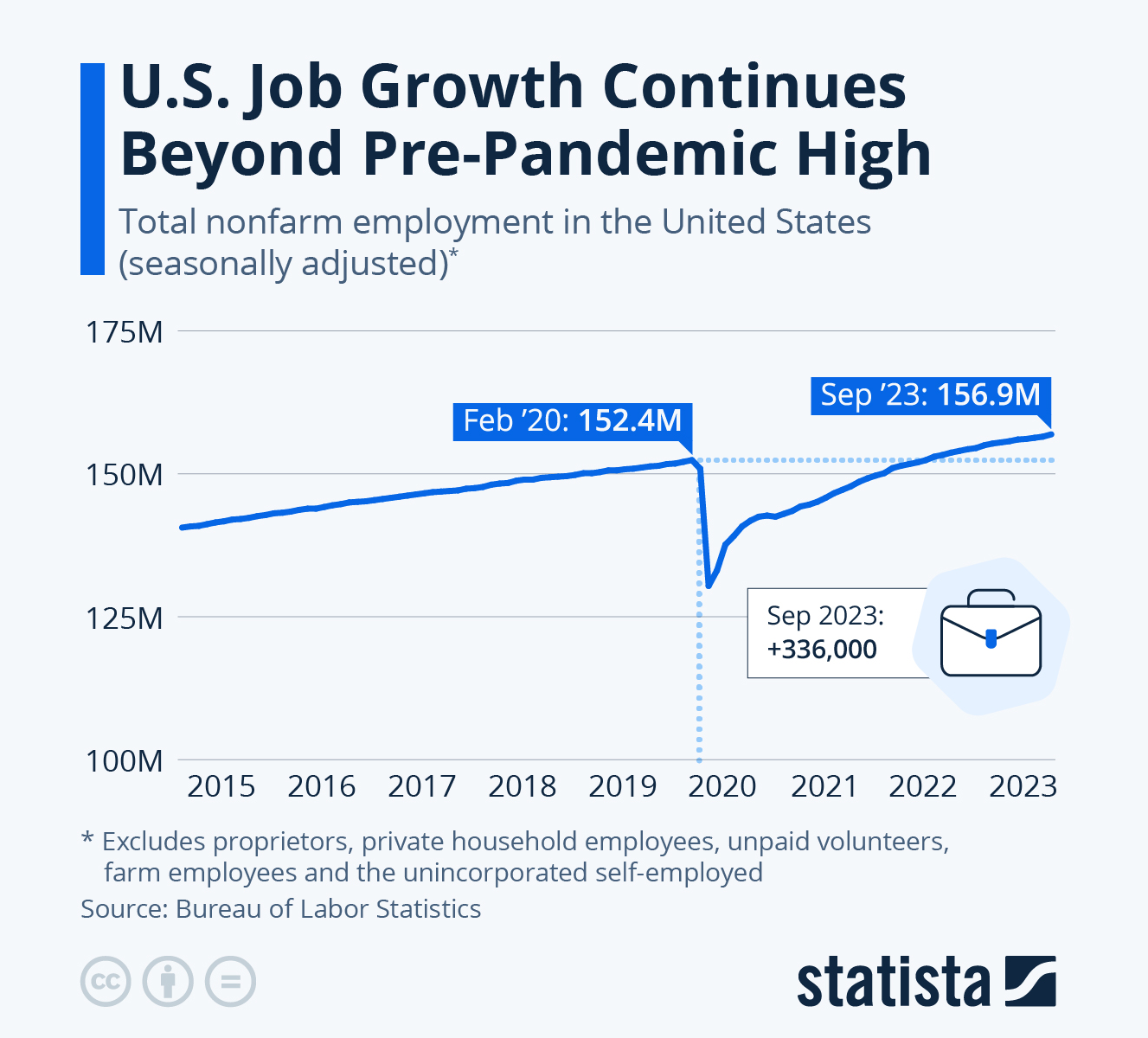

Too much money means people would be willing to spend more for the same products, and this is just one of the many causes that can lead to inflation with all things having been considered and taken into account. It turns out that job growth in the US has actually outpaced pre-pandemic highs, suggesting that inflation may very well get worse than might have been the case otherwise.

With all of that having been said and now out of the way, it is important to note that 336,000 new jobs were created in the month of September alone. This is nearly twice the 170,000 new jobs that were estimated, which seems to suggest that the Fed is failing to keep its grip on the economy that it has been tasked with managing.

Upon the announcement that more jobs were created than were initially expected, the stock market took a bit of a tumble. However, the pulse pounding trading session that occurred on Friday ended on a high when the S&P 500 posted a growth rate of 1.18%. This indicates that investors are prioritizing the rapidly cooling growth in wage rates. While new jobs are being created, wages are still stagnating, and this creates hope that the system will cool down as the money supply starts to dwindle.

Furthermore, it appears that the unemployment rate has remained stable despite the enormous quantity of new jobs being created. People are not able to take these new jobs on, and that is giving investors more hope that the stock market will rise. The interconnected system of commerce requires a delicate balancing act, and oftentimes seemingly harmful things like a lack of new jobs can be for the greater good.

However, it is important to recognize how the current state of affairs is impacting individuals, many of whom are unable to pay their bills. The Fed might not need to hike interest rates further due to the stock market’s surprise turnaround.

H/T: Statista

Read next: FTC Highlights Profits Worth Billions Made By Scammers Through Fraud Conducted On Social Media

by Zia Muhammad via Digital Information World

No comments:

Post a Comment