Investor capital is the lifeblood of any business that wants to grow; it's the steam that keeps the engine turning. Without it, everything grinds to a halt.

So while money might not actually make the world go round, it's definitely what drives businesses forward.

And the bigger your ambition, the more capital you need.

This is the principle behind the latest research by the team at Switch On Business. It delves into which US-based CEOs have raised the largest amounts of capital for their companies.

The team collected and analyzed data from Crunchbase, then translated it into a series of maps showing the most successful fund-raising CEOs in every US state.

Let's take a closer look at the results.

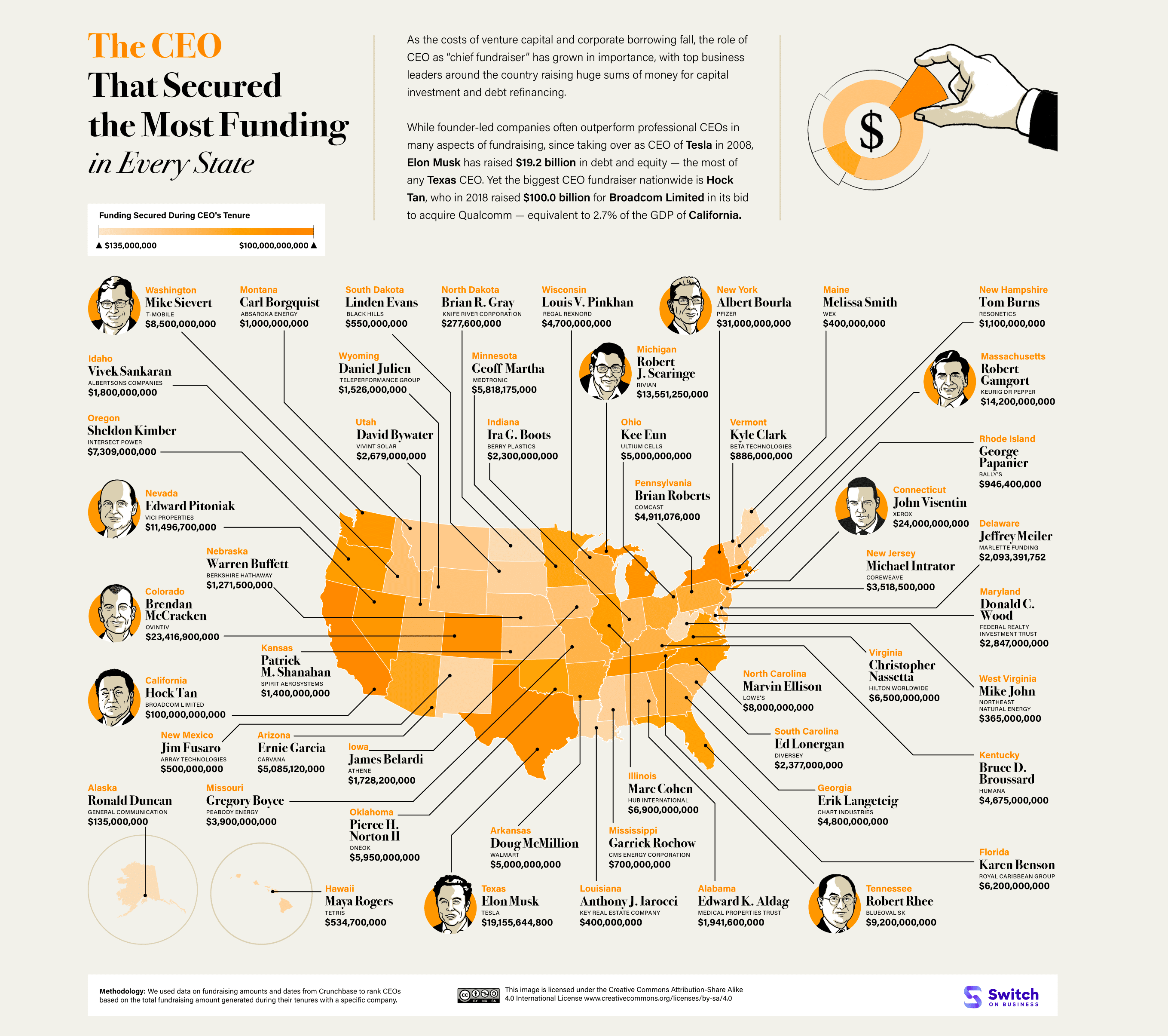

The CEO who secured the most funding for any US company

Hock Tan must have delivered a seriously great pitch when coming face-to-face with potential investors. In total, the CEO of Broadcom Limited secured a staggering $100,000,000,000 for his company's future growth plans. And if you're struggling with all those zeros, they translate to $100 billion.

That's the single largest amount of funds landed by any CEO of any US company.

So what did Hock Tan do with all that investment?

Well, quite a lot.

The investment was instrumental in transforming Broadcom into a major player in the semiconductor industry. The firm later expanded beyond semiconductors to build and deliver a wider range of technology solutions, including software and computing infrastructure.

Hock Tan is famous for wooing investors. But he's not afraid to play hardball when necessary, an approach which has often placed him in the spotlight, and not always for the best reasons. His business strategy included a hyper-aggressive takeover of semiconductor and wireless technology provider Qualcomm. However, this was one of the few battles Tan lost. The move was blocked by the US government in 2018.

But it turned out to be nothing more than a minor setback for Tan. Broadcom went on to complete several significant acquisitions under Tan's leadership, including a massive $37 billion deal for Broadcom Corporation. Other notable acquisitions include CA Technologies and Symantec's enterprise security business.

The CEO that secured the most funding in every US state

No other CEO has come close to securing the $100 billion landed by Tan.

However, there are a few that have still managed to put up some pretty huge numbers.

They include Albert Bourla, who is New York's most successful CEO when it comes to generating capital. Bourla is the Chairman and CEO of Pfizer; the data shows he's raised just over $31 billion for the pharmaceutical giant.

And Brendan McCracken hasn't done too badly since taking over as the top executive at Ovintiv Inc. As Colorado's top fundraising CEO, he's raised a very impressive $24 billion.

You'll probably recognize Texas's number one fundraising CEO; it's SpaceX and Tesla visionary Elon Musk. Otherwise known as the real Tony Stark. Or the biggest douchebag in the world. It depends on who you ask.

Musk has generated $ 19 billion in investor funding, but not without a fair share of controversy. Elon's aggressive capital-raising strategies have been labeled risky by many analysts, with some even labeling the CEO a confidence man or a modern-day snake oil salesman. Still, Tesla has continued to maintain a rapid period of income and expansion and is leading the way in bringing greener cars to the masses. So time will tell if all those edgy tweets have really paid off.

Another familiar name in finance and investing took the number one spot in Nebraska. It's legendary money magician Warren Buffett, the co-founder, chairman, and CEO of Berkshire Hathaway. Known as the ‘Oracle of Omaha’ due to his ability to predict future financial moves, Buffett is widely regarded as one of the shrewdest money managers of all time.

Buffett is worth an estimated $130 billion and is still going strong at the age of 93. Despite his colossal personal wealth, Buffett, like many other CEOs, prefers it when investors put up their money for his next venture. He’s convinced investors to hand over $1.27 billion.

Florida's Karen Benson is one of the few female CEOs that appears in the research. She's also the biggest female fundraiser. The shipping line boss, who captains the Royal Caribbean Group, has raised $6.2 billion since heading up the board.

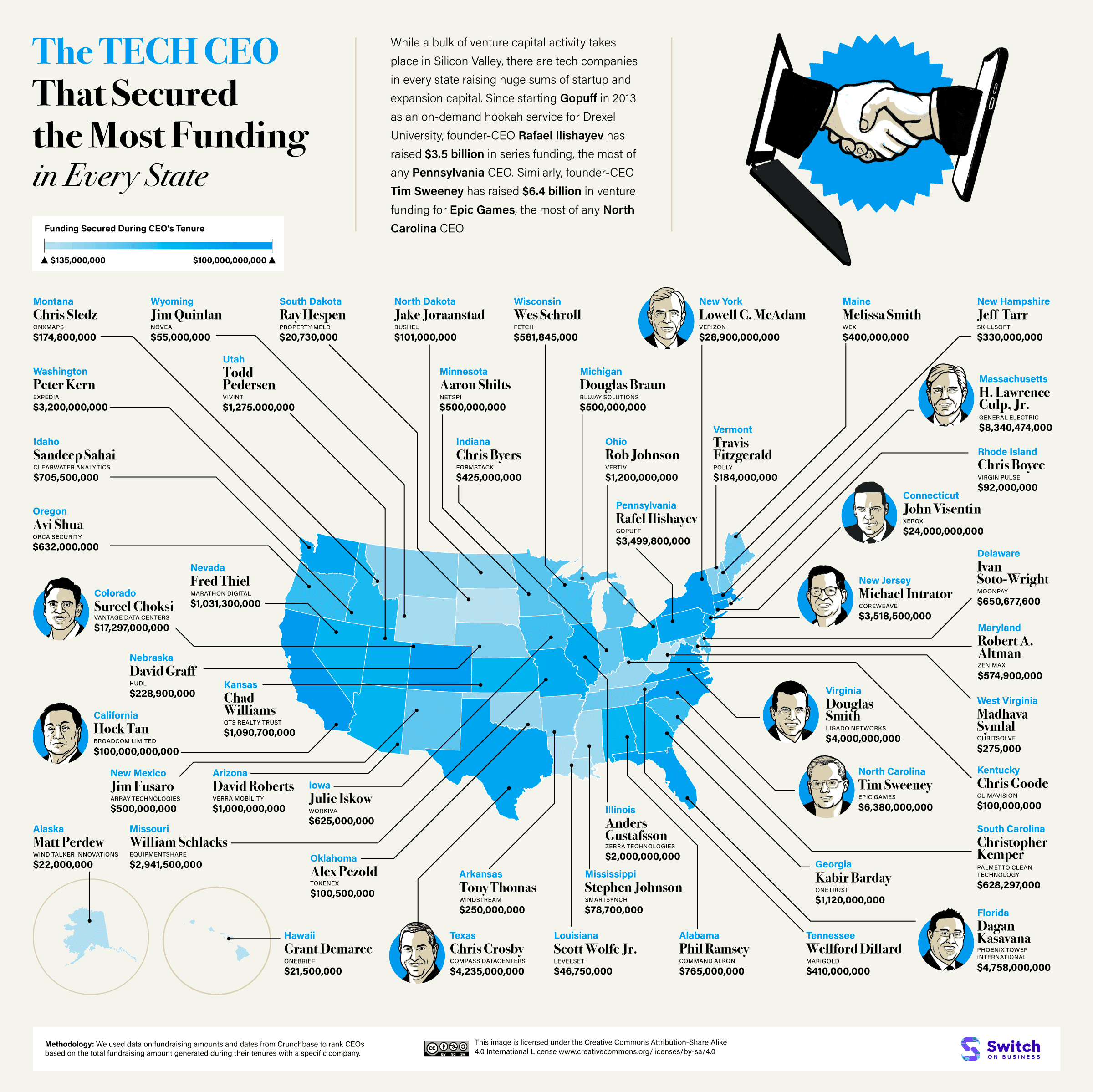

Tech CEOs that have raised the most funding in every state

The next part of the study examined data on which tech CEOs in every US state have raised the most capital for their companies.

Former Verizon CEO Lowell C. McAdam is New York's best tech boss for generating funds. Between 2006 and 2018, he steered the telecom giant through a period of huge growth and expansion, raising around $29 billion along the way.

Fred Thiel is Nevada's most successful CEO regarding fresh investment capacity. He also heads up one of the most interesting companies in the study. Marathon Digital Holdings is a prominent player in the emerging cryptocurrency industry, with a focus on mining Bitcoin.

The company is an industry leader due to its sustainable operations that leverage the latest technology and renewable energy sources to mine in a way that minimizes environmental impact while monetizing stranded energy sources.

It's a green approach that has persuaded many investors to allocate more than a billion dollars of their money to support and grow Marathon's operations.

Other tech CEOs who have raised billions for their companies include Colorado's Sureel Choksi, boss of Vantage Data Centers, and John Visentin, who makes the big calls at software company Xerox, headquartered in Connecticut.

The capital raised by Madhava Syamlal is minuscule compared to some of the figures we've been discussing. Syamlal has raised 'just' $275,000 for QubitSolve Inc, based in West Virginia. But it's not necessarily his fault. Instead, Syamlal might be too far ahead of the tech game.

QubitSolve Inc. is at the very cutting edge of cutting-edge technology. It builds and develops quantum computers, which use advanced theoretical knowledge to allow computer code bits to exist in multiple states simultaneously, accelerating computing power by truly mind-boggling degrees. Try summing that up in a catchy pitch board for 'boomer' investors.

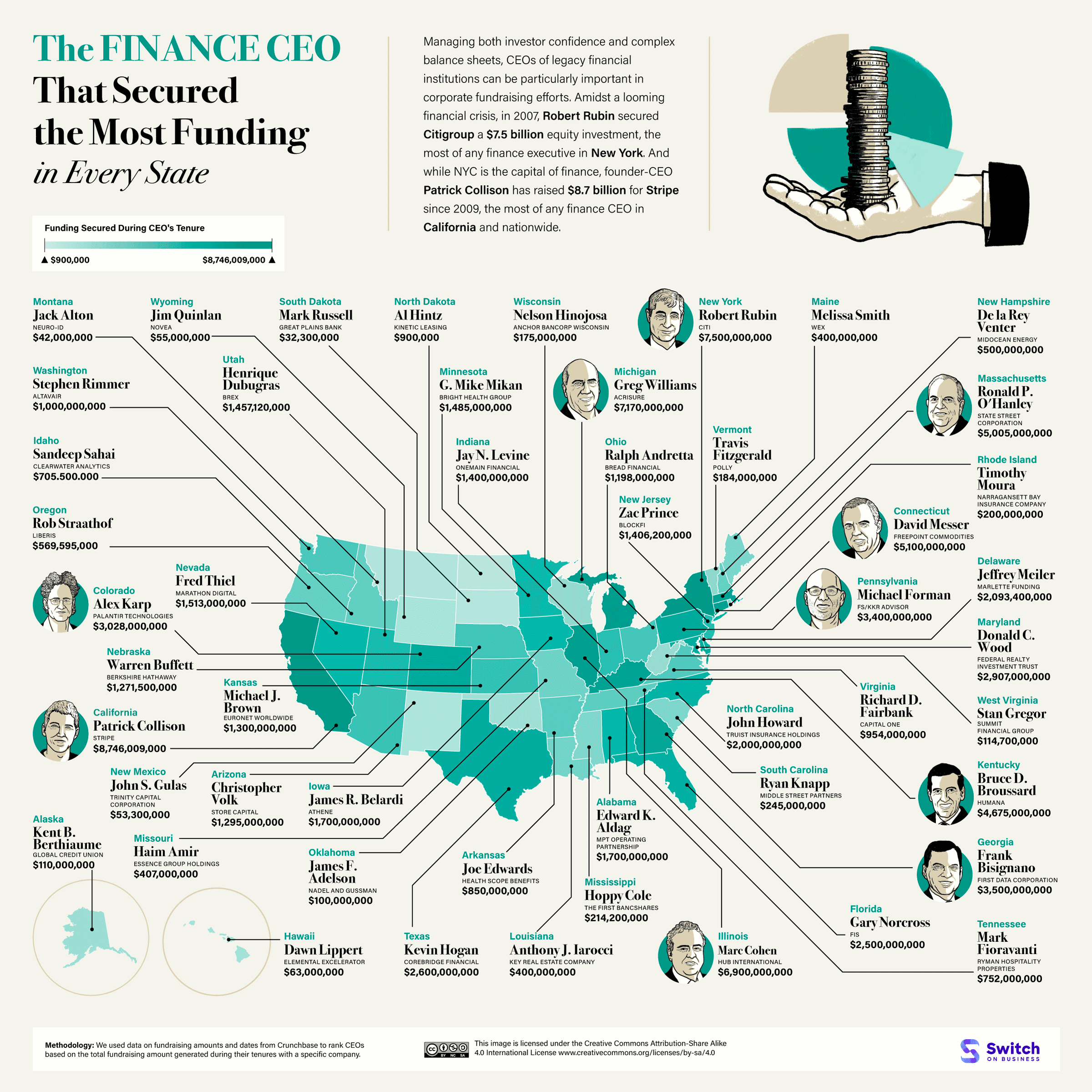

The top fundraising finance CEOs across the USA

If anyone knows how the money-raising game works, then it's the heads of the USA's biggest and wealthiest finance companies.

New York is the finance capital of the world, so it's no surprise that one of the biggest fund-raising CEOs is based in the Big Apple. His name is Robert Rubin, the former head of the CITI banking group, who raised $7 billion.

Impressive stuff. But for a seasoned (and very well connected) financial leader like Rubin, that's probably not as hard as it sounds. Before taking over the bank, Rubin served as the 70th US Secretary of the Treasury during the Clinton administration. He also spent 20 years as a senior consultant at Goldman Sachs, followed by positions on the board of directors at the New York Stock Exchange, the US Securities and Exchange Commission, and the Financial Services Advisory Committee.

In other words, Robert Rubin's contact list was a 'who's who' of the most influential people in finance, and he'd built up a long list of favors to call in by the time he became CITI's boss. This was one guy who everyone called back, and you never said no to an investor pitch by Rubin.

Read next: US CEOs demonstrate exceptional fundraising prowess, securing billions for company growth and innovation.

by Irfan Ahmad via Digital Information World

No comments:

Post a Comment