Advertising on apps has come under fire because of the fact that this is the sort of thing that could potentially end up invading user privacy. Companies like Apple have attempted to curtail the non-consensual use of user data by toggling third party tracking off by default, thereby making users have to opt in for this form of tracking if they feel like it is worth it. In spite of the fact that this is the case, advertising continues to be a massive driver of revenue for the app economy.

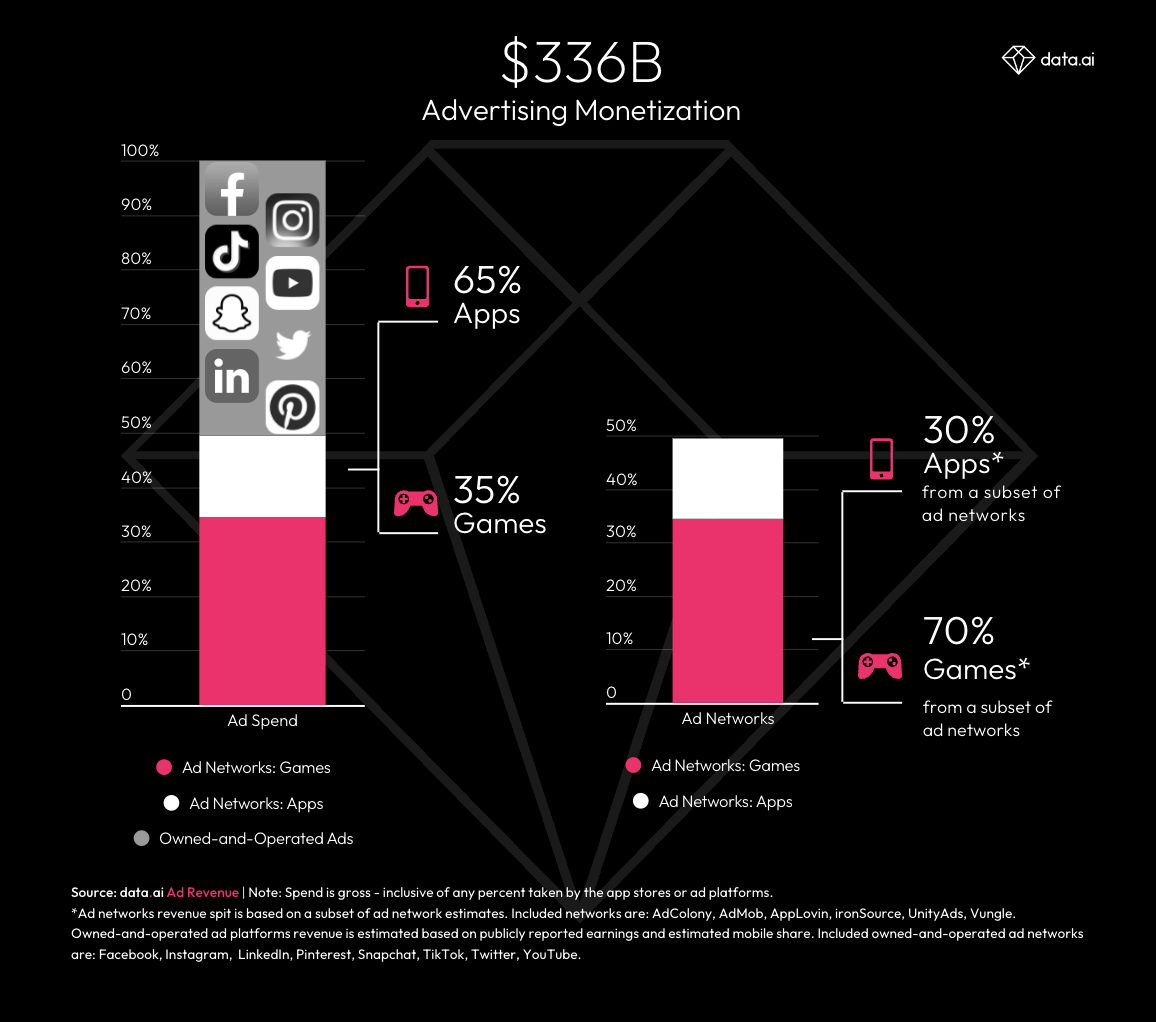

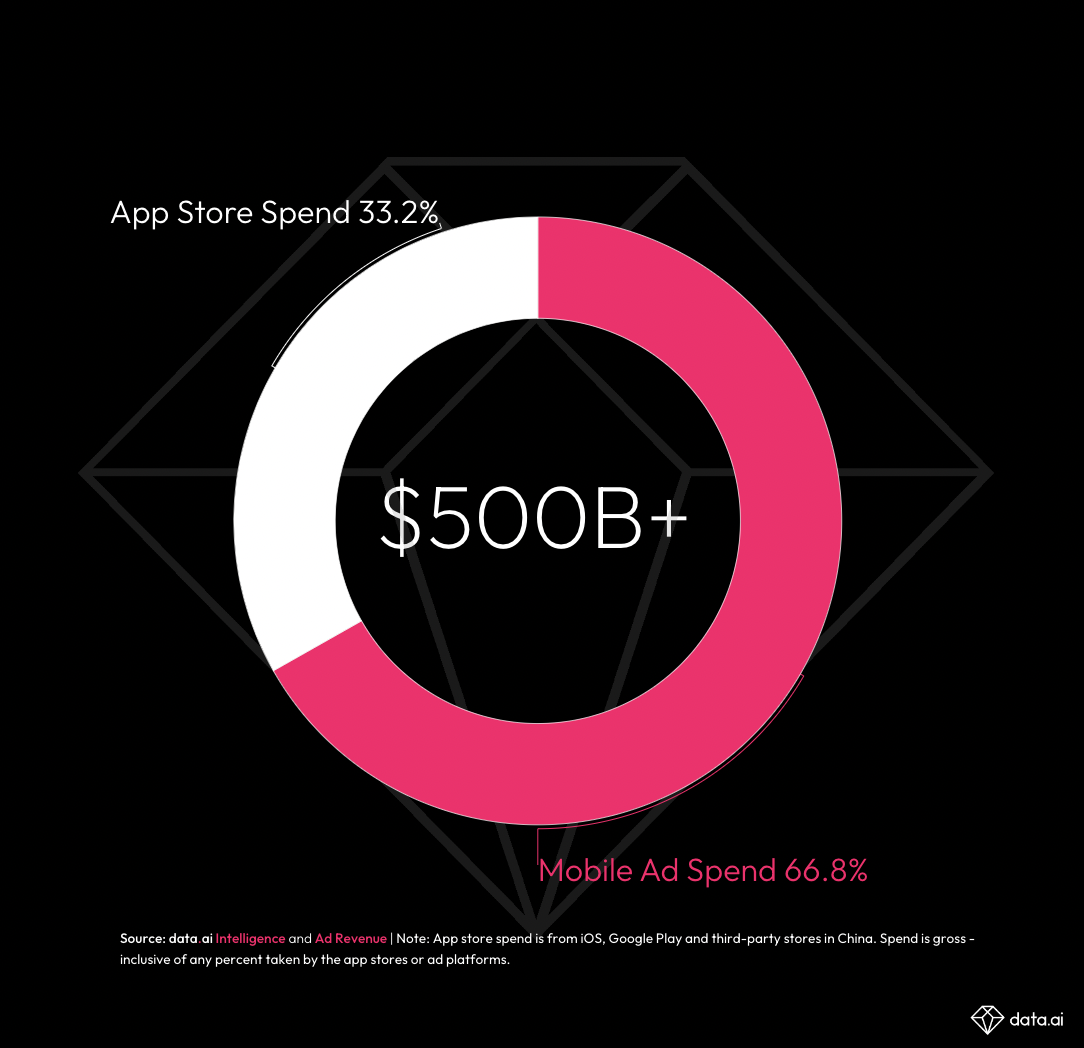

It is currently estimated that the annual revenues brought in by these apps sits at around $500 billion. With all of that having been said and now out of the way, it is important to note that 67% of this revenue, or $336 billion to be precise, comes from advertising. The remaining 33%, which comes up to approximately $167 billion, comes from purchases that users make within the app.

50% of the ad revenue received by apps went towards so called owned and operated ads. The term refers to ads that are owned by the platforms themselves rather than being provided by a third party. These include the likes of Instagram, TikTok, Facebook, YouTube, Twitter, LinkedIn, Snapchat and Pinterest.

35% was earned by games, and 15% was distributed between other apps with all things having been considered and taken into account. However, games tend to receive far more revenue from in app purchases. 66% of in app purchases revenue was earned by games, so the shortfall in terms of ad revenue is more by design rather than suggesting an inherent flaw.

Also, the massive setbacks caused by App Tracking Transparency and crackdowns by the EU did not hinder the growth of advertising revenue. It grew by about 14% in 2022, which is far higher than the 2% increase seen in in-app purchasing.

When comparing various regions, North America unsurprisingly topped the list in term of how much revenue was generated. Approximately half of all advertising revenue came from this region, with China coming in second with a share of 23%. China is followed by Europe which had a 19% share of total ad revenue for 2022.

A unique trend that has emerged is that of one time purchases. Previously being seen as the sole purview of gaming apps, other apps like TikTok have been utilizing this method to great effect since it can make revenues higher than might have been the case otherwise. It will be interesting to see if apps other than TikTok try to adopt this model, since it has been doing wonders for the companies profit margins.

Most apps on both the Apple App Store and the Google Play Store use what is called a mixed monetization strategy. For example, while 90% of the revenue earned by YouTube comes from ads, it still relies on in-app purchases such as subscriptions for 10%. Subscription models are dominating the in-app purchasing segment as well, even though games tend to take up the bulk of the earnings on that front.

Advertising is still the bread and butter of most major apps. This does not look like it will change in the near future.

H/T: DataAI

Read next: U.S. Paid Search Spend to Reach $110 Billion in 2023

by Zia Muhammad via Digital Information World

No comments:

Post a Comment