Many developing countries have been going through a tough time since the COVID outbreak. The amount of economic decrement drives them to the edge of growing responsibilities and tension to avoid future bankruptcies and safeguard the needs of their people.

To combat inflation in developing nations, the government has begun investing in cryptocurrencies. The Middle East has long been one of the smallest markets when it comes to investing in something like cryptocurrency.

However, since the boom in inflation, Middle East countries have faced many challenges, and to cope with these challenges, they have started taking an interest in cryptocurrency. Both the Middle East and North Africa (MENA) have become fertile ground for crypto.

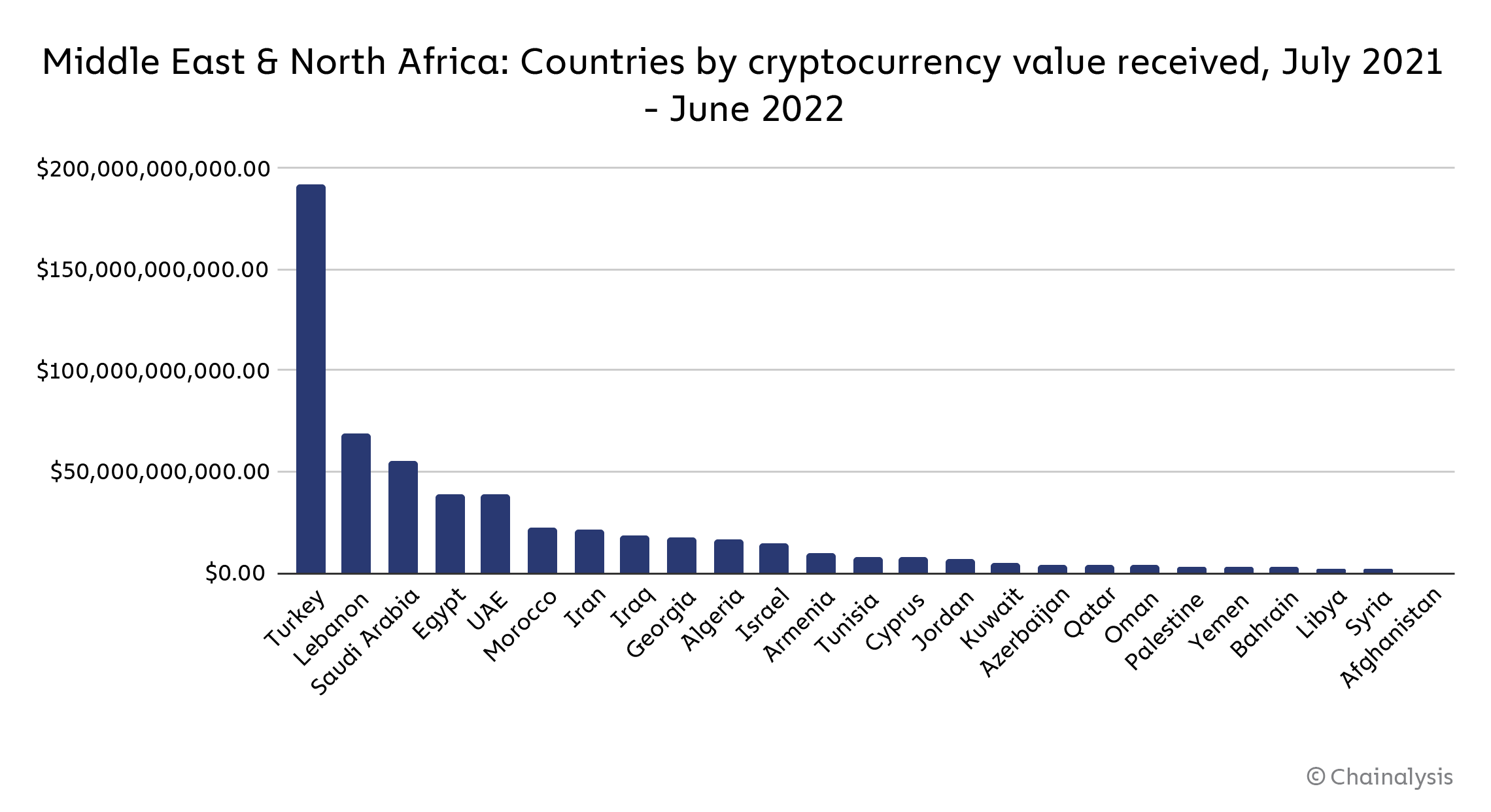

The researchers from Chainalysis recorded the surge in received cryptocurrency in Middle East countries. 48% of the crypto asset has been received by MENA in one year. Not just that, they have profited more than $566 billion from cryptocurrency. MENA has left behind other countries to gain more profit. Latin America is said to be the second fastest-growing crypto market at 40%, whereas North America is at 36%.

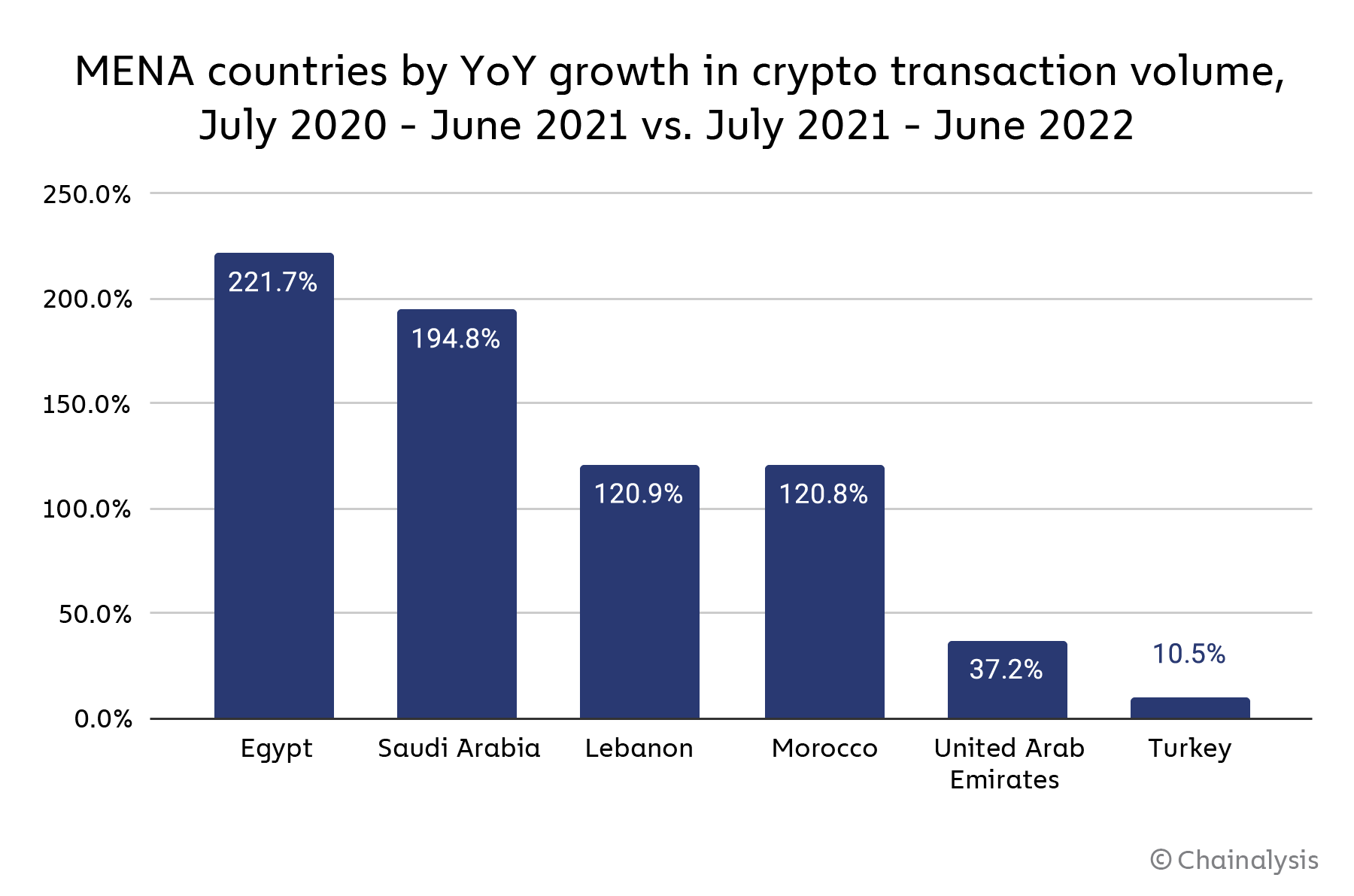

The growth of the crypto market proliferates due to the high inflation rate among developing countries. Egypt and Turkey faced ups and downs during the inflation to keep up with the cryptocurrency investments. Chainalysis reported that this decrease has led to investment in crypto to stabilize the financial complications.

Chainalysis also testified that MENA provides a stable ground to more than 30 other countries having higher crypto adoption rates. For instance, Egypt stands at 14th position, while Turkey is at 12th and Morocco at 24th, according to the report released by Global Crypto Adoption Index.

Furthermore, Turkey has seen the biggest downfall in its economy in the year 2020. Turkey is considered to be the largest growing market in crypto in the MENA, and the main reason behind the surge is the inflation in the economy. The Turkish Lira is said to record the lowest compared to the US dollar. The Egyptian pound has also dropped increasingly.

Thanks to the crypto market, these countries are trying to balance their financial problems by investing in crypto. Turkey has received $192 billion in cryptocurrency, while Egypt has its own game to keep up with the competitors and received 222 billion dollars.

After observing the rise in the volume of crypto asset savings transactions in Egypt, other countries with rising inflation have decided to learn from it. For instance, Morocco attempted to alter the course of its government by moving toward the cryptocurrency market. They have decided to fully embrace the new culture to safeguard their consumer interests and prevent the collapse of the government.

Meanwhile, Egyptians are strengthening their ties with the biggest investors, UAE. Egypt and UAE have made a pact to build a bridge crypto-based remittance corridor to further their investments. UAE is considered to be the third-largest crypto market in the MENA.

Although the crypto market is a great opportunity for all developing countries, it also harbors wealthy countries. The Gulf Cooperation Council reported that UAE, Saudi Arabia, and Dubai are the richest in the market and not just in the Middle East. They also reported that the crypto market supports developing countries to let them balance their economic conditions.

Despite this fact, Afghanistan has refused to invest in crypto assets since the intervention of the Taliban. However, countries like Vietnam, the Philippines, and Ukraine are rapidly growing and benefitting from the market.

Read next: Around 3 Billion People In The World Cannot Afford A Healthy Diet And This Is Concerning To Say The Least

by Arooj Ahmed via Digital Information World

No comments:

Post a Comment