Meta is really switching things up after the tech giant was recently seen announcing a new feature for advertisers in India.

The company says it will allow advertisers to make their ad payments via free-of-cost monthly installments to enable convenience. These installments will be over a three-month period. This is said to help the social media company better expand its advertising operations across the South East Asian subcontinent.

The decision was announced at the company's yearly business summit. A lot of emphases was put on the new feature that gives advertisers linked to Meta the chance to convert ad payments arising between $40 to $6300 into very equal installments that are paid on a monthly basis.

Advertisers are required to make payments for different campaigns via credit cards from different banks so they can avail the free of cost EMI mode of payments, the company mentioned.

Common banks delineated included the likes of Citibank, Axis Bank, India’s State Bank, and the ICICI Bank. All banks taking part will require users to pay interest on every amount that is transacted.

However, the tech giant revealed how it would be the one bearing expenses related to interest to the bank. Simultaneously, it would be offering a straight-up discount to advertisers related to ad spending.

See, the whole idea is to motivate small firms in the country to come forward and take part. This is especially for those who are feeling the effects of the current economic downturn and hence, are finding it hard to make payments directly during testing times. Therefore, that’s one reason why they’re not taking part in purchasing ads across both Facebook and Instagram apps.

Meta has also declared a new chat support system that will be up for grabs round the clock so any active advertisers in the country may avail themselves when they desire. This is called the Business Help Center.

A spokesperson for Meta in India was seen announcing how the move will make sure advertisers of Meta in India gain access to both financial and ad support services, through the click of a button. This is to help them attain growth and better opportunities.

Meta also highlighted how it realizes that every company’s journey and workings are different. But now, it hopes this new decision can assist in providing focused solutions, keeping users’ needs in mind.

Just last year, the tech giant launched a new program that was designed to provide small and large-scale firms get the best loans. And now, that is also seeing further expansion in the country.

In case you’re wondering why Meta has such a keen interest in India, well, the answer is simple. The tech giant identifies the firm as one of the biggest user markets around the globe. But the same can’t be said about income. Therefore, it’s working hard by India’s side so that even small firms get motivated to expand and better their reach.

Meta says there’s a huge gap in revenue when you look at the North American/European region compared to that seen in the Asia Pacific region. Therefore, it wishes to close or lessen the gap by providing more opportunities.

Read next: Meta’s Dreams Of Turning WhatsApp Into A ‘Super App’ Are Coming True In India

by Dr. Hura Anwar via Digital Information World

"Mr Branding" is a blog based on RSS for everything related to website branding and website design, it collects its posts from many sites in order to facilitate the updating to the latest technology.

To suggest any source, please contact me: Taha.baba@consultant.com

Thursday, September 1, 2022

The most hated and annoying mobile apps in the world

Mobile apps! We can't live without them - or at least that's what it feels like - but sometimes we wish they'd never been invented. How many times have you deleted and reinstalled Twitter or your Tinder profile?

Apps epitomize the double-edge nature of digital innovation in the modern era. We love apps. We hate apps. They make life easier. They create a whole new set of problems. Doom-scrolling much?

But which of the apps really drive us crazy?

ElectronicsHub decided to investigate. Using geotagged Twitter data, it looked at the percentages of negative Twitter mentions and then created several maps and lists of the most hated apps in every county.

Here's a close look at what Electronics Hub found out.

Common frustrations include a large number of bot accounts and spammers, slow or poor updates, and growing toxicity among long-time community members.

But when it comes to the actual percentage of all negative tweets from around the world, dating app Hinges comes out on top.

Over one-third (34.4%) of every tweet mentioning Hinge was negative or critical of the app! Not good. No wonder it's been losing thousands of users every month.

So why do so many singletons and romance seekers hate Hinge?

"Tiny user base," tweeted one frustrated user. "Hardly anybody on there, and almost impossible to find someone looking for something serious."

For others, Hinge's biggest problem is the failure to distinguish itself from other dating apps, including those with more of a hook-up vibe.

"Hinge says it attracts quality people, not idiots with no respect," reads one tweet. "Not true. Still receiving d-pics on the regular and ghosting from fools. It's the same as every other d-app. Just rubbish.”

Netflix lost 1million subscribers during the first half of 2022. But it still only came third in the irksome entertainment apps list. Stream took the dubious honor of the most hated entertainment app. Disney+ separates the two.

But how could anyone hate Disney?

Lots of people, apparently. Disney+ had the highest number of 'bad tweets' in 18 countries, including Russia, China, Paraguay, and South Africa. "Not enough original shows,'' tweeted one disgruntled subscriber. "And the selection of movies is poor. You can only watch Star Wars so many times. Not worth the money.”

Facebook Messenger is the social media app causing its users the most grief. It was mentioned in more negative tweets than any other social media app in Australia, Cambodia, India, and 30 other countries; no wonder Zuckerberg realized it was time for a rebrand.

Western Union is the most hated money transfer app in the Twitter sphere. Most criticism stems from Western Union's high transfer fees and commission. "I had to pay $25 to send my money to my family," reads one rage tweet. "They can do this because I had no other option. Disgusting."

New crypto apps pose an existential threat to companies like Western Union. But some will have to up their game before their CEOs can think about usurping legacy payment systems like Western Union.

Mobile payment service Cash App has around 30 million active users. But many are not happy with the service - and they tweet about it. In fact, they made Cash App the most hated payment app on a country-by-country basis - and by quite a long way. Cash App is the most hated app in 29 countries. Second place Block-Fi is hated the most in 'only' 16 countries.

And there's more bad news for Facebook Messenger. It's the most hated app in 21 of 50 states. Americans are also falling out of love with Twitter. Twitter is now the most hated app in California, Texas, New York, Florida, and Illinois – the five largest states by population!

Check out a full breakdown of the world's most hated apps in the charts and table below:

Read next: According to new data your home device might know you better than your family

by Irfan Ahmad via Digital Information World

Apps epitomize the double-edge nature of digital innovation in the modern era. We love apps. We hate apps. They make life easier. They create a whole new set of problems. Doom-scrolling much?

But which of the apps really drive us crazy?

ElectronicsHub decided to investigate. Using geotagged Twitter data, it looked at the percentages of negative Twitter mentions and then created several maps and lists of the most hated apps in every county.

Here's a close look at what Electronics Hub found out.

The most hated app in the world

Online game creation platform Roblox is the most hated app in the world, according to the research from Electronics Hub. It racked up the most negative tweets in 21 countries, more than any app in the study.Common frustrations include a large number of bot accounts and spammers, slow or poor updates, and growing toxicity among long-time community members.

The app that everybody really hates

Roblox is the most hated app when looking at the data on a country-by-country basis.But when it comes to the actual percentage of all negative tweets from around the world, dating app Hinges comes out on top.

Over one-third (34.4%) of every tweet mentioning Hinge was negative or critical of the app! Not good. No wonder it's been losing thousands of users every month.

So why do so many singletons and romance seekers hate Hinge?

"Tiny user base," tweeted one frustrated user. "Hardly anybody on there, and almost impossible to find someone looking for something serious."

For others, Hinge's biggest problem is the failure to distinguish itself from other dating apps, including those with more of a hook-up vibe.

"Hinge says it attracts quality people, not idiots with no respect," reads one tweet. "Not true. Still receiving d-pics on the regular and ghosting from fools. It's the same as every other d-app. Just rubbish.”

Most hated apps by category

Tinder is the most hated dating app, when breaking the tweets down by location. Twenty-nine countries included in the study swiped left on the OG dating app.Netflix lost 1million subscribers during the first half of 2022. But it still only came third in the irksome entertainment apps list. Stream took the dubious honor of the most hated entertainment app. Disney+ separates the two.

But how could anyone hate Disney?

Lots of people, apparently. Disney+ had the highest number of 'bad tweets' in 18 countries, including Russia, China, Paraguay, and South Africa. "Not enough original shows,'' tweeted one disgruntled subscriber. "And the selection of movies is poor. You can only watch Star Wars so many times. Not worth the money.”

Facebook Messenger is the social media app causing its users the most grief. It was mentioned in more negative tweets than any other social media app in Australia, Cambodia, India, and 30 other countries; no wonder Zuckerberg realized it was time for a rebrand.

Western Union is the most hated money transfer app in the Twitter sphere. Most criticism stems from Western Union's high transfer fees and commission. "I had to pay $25 to send my money to my family," reads one rage tweet. "They can do this because I had no other option. Disgusting."

New crypto apps pose an existential threat to companies like Western Union. But some will have to up their game before their CEOs can think about usurping legacy payment systems like Western Union.

Mobile payment service Cash App has around 30 million active users. But many are not happy with the service - and they tweet about it. In fact, they made Cash App the most hated payment app on a country-by-country basis - and by quite a long way. Cash App is the most hated app in 29 countries. Second place Block-Fi is hated the most in 'only' 16 countries.

USA's most hated apps

Almost 85% of people living in the USA own a smartphone. So it's a great place to see how modern humans feel about the app they use every day.And there's more bad news for Facebook Messenger. It's the most hated app in 21 of 50 states. Americans are also falling out of love with Twitter. Twitter is now the most hated app in California, Texas, New York, Florida, and Illinois – the five largest states by population!

Check out a full breakdown of the world's most hated apps in the charts and table below:

Read next: According to new data your home device might know you better than your family

by Irfan Ahmad via Digital Information World

Return Policies Shown to Impact Consumer Loyalty and Purchases

A lot of work is done to optimize the customer journey, but with all of that having been said and now out of the way it is important to note that the post purchase journey is also crucial. Loop’s recent survey revealed that return policies are an important aspect of the post purchase experience because of the fact that this is the sort of thing that could potentially end up improving the loyalty that customers feel towards brands.

97% of customers said that they like brands with flexible return policies since this gives them the impression that the brand cares about its consumers with all things having been considered and taken into account. Additionally, 96% of consumers who participated in this survey stated that they read the return policy before making a purchase, and 54% said that they might avoid buying products from brands whose return policies are too rigid.

Returns can allow brands to gain repeat customers, with 87% saying that such incentives would make them more likely to buy from a brand again than might have been the case otherwise. 52% also stated that they enjoyed post purchase vouchers which is another useful tool for brands to use.

In spite of the fact that this is the case, most brands are not willing to make product returns easier for customers. Customers want easy, environmentally friendly return options, and with 80% of customers saying that they plan to reduce expenses due to inflation brands might need to address their concerns and reap the benefits of having gained their loyalty once all has been said and is now out of the way.

43% of consumers said that returns were too time consuming and required too much effort, and 42% said that they would prefer a drop off option that would allow them to get the product shipped back to the retailer. Only 18% said that they preferred to go directly to the store to drop returns off, and brands are currently only catering to this minority due to their short sighted viewpoint which absolutely must change if they don’t want to end the year on a loss.

Read next: New survey reveals internet users are more concerned about data safety

by Zia Muhammad via Digital Information World

97% of customers said that they like brands with flexible return policies since this gives them the impression that the brand cares about its consumers with all things having been considered and taken into account. Additionally, 96% of consumers who participated in this survey stated that they read the return policy before making a purchase, and 54% said that they might avoid buying products from brands whose return policies are too rigid.

Returns can allow brands to gain repeat customers, with 87% saying that such incentives would make them more likely to buy from a brand again than might have been the case otherwise. 52% also stated that they enjoyed post purchase vouchers which is another useful tool for brands to use.

In spite of the fact that this is the case, most brands are not willing to make product returns easier for customers. Customers want easy, environmentally friendly return options, and with 80% of customers saying that they plan to reduce expenses due to inflation brands might need to address their concerns and reap the benefits of having gained their loyalty once all has been said and is now out of the way.

43% of consumers said that returns were too time consuming and required too much effort, and 42% said that they would prefer a drop off option that would allow them to get the product shipped back to the retailer. Only 18% said that they preferred to go directly to the store to drop returns off, and brands are currently only catering to this minority due to their short sighted viewpoint which absolutely must change if they don’t want to end the year on a loss.

Read next: New survey reveals internet users are more concerned about data safety

by Zia Muhammad via Digital Information World

Susan Wojcicki Reveals She Was Approached By Tesla To Become Elon Musk’s Second In Command

YouTube CEO Susan Wojcicki, as per a book titled "Like, Comment, Subscribe: Inside YouTube's Chaotic Rise to World Domination" by Mark Bergen, was in talk with Tesla to become the company’s COO back in 2014.

Some super-rich people wanted another super-rich person for their corporation, but the latter rich person decided that they wanted to stay loyal to the current overlords than jump ship. There, that’s the entire story, everyone can head home now. I think the vibe that I’m attempting to emulate here is less disdain over another boring corporate story (although some of that’s here), and more annoyance over dealing with such an uninteresting story. Although other people can find this interesting, I don’t have a monopoly over what commands another’s attention, I don’t care for such stories. However, the job’s been assigned, and I’ll trudge through this article as effectively as I can. Let’s get down to brass tacks, and discuss Susan Wojcicki’s attitude towards being offered a job at Tesla.

Wojcicki isn’t exactly the most beloved figure within the YouTube space, but if I’m being honest, she’s not the worst either. Her current tenure as CEO of YouTube has been marked by attempts towards marketing the platform as more advertiser-friendly; i.e. the promotion of content that is safe, wholesome, and attracts kids. Many people have (rightfully so) criticized her for YouTube’s poorly defined policies; videos with “edgy” content get regularly demonetized, but Logan Paul makes a video disrespecting suicide and serious ramifications only follow after severe public outrage. Ultimately, she’s just another corporate person, looking to make money by appealing to middle America or whatever the new buzzword is for a general audience.

Her position as YouTube CEO was also more than guaranteed, considering just how long Wojcicki has worked with Google. She’s been with the company since its inception, with Google’s first offices being set up in her parent's garage. She was also responsible for the purchase of YouTube and was the first product manager for AdSense; making her the CEO of YouTube was a no-brainer at this point. However, things would have looked much different if Susan Wojcicki had taken up a job offer from Tesla back in 2014.

This was a transitional period for Google and Alphabet as a whole. Larry Page was leaving the company and handing over the reins to Sundar Pichai. This in and of itself was surprising to many people who worked at the company, since they expected Wojcicki to herself be next in line. Tesla approached the product manager at around this time with an offer to become the company’s COO; a position as Elon Musk’s right-hand woman. However, she ultimately expressed loyalty to the company at its core and was soon promoted to YouTube CEO. All’s well that ends well, I guess; then again, whatever route Susan Wojcicki took, she was going to fail upwards.

Photo: TechCrunch

Read next: The Business Apps That Collect The Most and Least Data

by Arooj Ahmed via Digital Information World

Some super-rich people wanted another super-rich person for their corporation, but the latter rich person decided that they wanted to stay loyal to the current overlords than jump ship. There, that’s the entire story, everyone can head home now. I think the vibe that I’m attempting to emulate here is less disdain over another boring corporate story (although some of that’s here), and more annoyance over dealing with such an uninteresting story. Although other people can find this interesting, I don’t have a monopoly over what commands another’s attention, I don’t care for such stories. However, the job’s been assigned, and I’ll trudge through this article as effectively as I can. Let’s get down to brass tacks, and discuss Susan Wojcicki’s attitude towards being offered a job at Tesla.

Wojcicki isn’t exactly the most beloved figure within the YouTube space, but if I’m being honest, she’s not the worst either. Her current tenure as CEO of YouTube has been marked by attempts towards marketing the platform as more advertiser-friendly; i.e. the promotion of content that is safe, wholesome, and attracts kids. Many people have (rightfully so) criticized her for YouTube’s poorly defined policies; videos with “edgy” content get regularly demonetized, but Logan Paul makes a video disrespecting suicide and serious ramifications only follow after severe public outrage. Ultimately, she’s just another corporate person, looking to make money by appealing to middle America or whatever the new buzzword is for a general audience.

Her position as YouTube CEO was also more than guaranteed, considering just how long Wojcicki has worked with Google. She’s been with the company since its inception, with Google’s first offices being set up in her parent's garage. She was also responsible for the purchase of YouTube and was the first product manager for AdSense; making her the CEO of YouTube was a no-brainer at this point. However, things would have looked much different if Susan Wojcicki had taken up a job offer from Tesla back in 2014.

This was a transitional period for Google and Alphabet as a whole. Larry Page was leaving the company and handing over the reins to Sundar Pichai. This in and of itself was surprising to many people who worked at the company, since they expected Wojcicki to herself be next in line. Tesla approached the product manager at around this time with an offer to become the company’s COO; a position as Elon Musk’s right-hand woman. However, she ultimately expressed loyalty to the company at its core and was soon promoted to YouTube CEO. All’s well that ends well, I guess; then again, whatever route Susan Wojcicki took, she was going to fail upwards.

Photo: TechCrunch

Read next: The Business Apps That Collect The Most and Least Data

by Arooj Ahmed via Digital Information World

Delete these business apps right now if you care about your online privacy

Let's be honest: no one - or almost no one - reads the privacy statement when downloading the most popular and useful business apps. Who's got time for that? And the stuff in there is all meaningless jargon, right?

Not quite.

Tucked away in these terms and conditions, you'll find an explanation of what these apps do with your data. And some of them do a lot more with it than others.

But don't panic. There's no need to read all the privacy statements of the apps on your phone. Because OnDeck has done it for you. And they put all their findings into several charts ranking the most and least data-hungry business apps.

You’ll find a summary of the results below.

But first, let's look at why apps collect your data and what they do once they have it.

In many cases, data collection is essential. Some apps wouldn't work without it. After all, how can Google Maps point you in the right direction if it doesn't know where you are at that moment?

And yes, apps do sell and share your personal data to marketers, research organizations, and cold-calling firms that are borderline scammers.

Many data collection practices are benign. Some are even beneficial.

But data collection still gets a bad rap, and it's easy to see why. Some of the biggest (and most trusted) companies in the world have been caught up in data collection scandals.

During the 2010s, personal data belonging to millions of Facebook users was collected without their consent by British consulting firm Cambridge Analytica. It was predominately used to influence voter behavior in elections and referendums, including the 2016 US presidential race and the UK's Brexit referendum.

Not good (unless you’re the owner of Cambridge Analytica.)

Some of the scandals are even worse, and a few are downright disturbing. Facebook was (once again) busted for using people's data and profile information to see how it could manipulate their emotions.

And there are those rumors. For years, there have been whispers that all the major tech companies have secret deals to give intelligence services access to your data. And it's naive to dismiss this as just another 'conspiracy theory.'

Over 80% of Palantir's (a major data analytics firm) contracts are with US governmental departments, including the CIA and the NSA - who, thanks to whistleblower Edward Snowden, admitted they'd been illegally spying on US citizens for years.

Thankfully, OnDeck has done the hard work for you already.

Instagram is the next app that has to go. Instagram is great for marketing, but it also has a huge appetite for your data. It collects just as many data segments as Facebook.

PayPal is another big culprit. The finance and accounting business app starts scooping up 26 pieces of data as soon as you download it.

Privacy-focused business people should be wary of content and file management tool Google Drive. It collects your contact info, info on recent purchases, search history, and 15 other personal data segments.

Finance and accounting apps come next (14 segments), followed by communication apps (11.3), and website and e-commerce apps (9.5 segments.)

At the other end of the scale, business intelligence apps are the least data-hungry apps in the OnDeck study. According to OnDeck’s research, business intelligence apps collect less than 5 (4.5) different pieces of personal data.

Some have rejected data collection altogether

The app for business intelligence and cloud-based services provider MicroStrategy collects zero data from its users. The firm's Privacy Policy statement opens with this reassuring line: "We are not in the business of selling Personal Information about you to advertisers or spammers."

Video conference app Webex Meeting doesn't want your data. Three other business communication apps don't believe in data collection. They are CallRail, Acefone, and 3XC.

Commander One and eFileCabinet might not have the same functionality as Google Drive. But they should be among the first alternatives for business professionals who’ve dumped Google Drive due to privacy concerns. Neither Commander One nor eFileCabinet is interested in a single piece of your private information.

It's time to take back control. See a full breakdown of all the results in the infographics below. Then decide which apps to keep and which apps to delete.

Read next: According to new data your home device might know you better than your family

by Web Desk via Digital Information World

Not quite.

Tucked away in these terms and conditions, you'll find an explanation of what these apps do with your data. And some of them do a lot more with it than others.

But don't panic. There's no need to read all the privacy statements of the apps on your phone. Because OnDeck has done it for you. And they put all their findings into several charts ranking the most and least data-hungry business apps.

You’ll find a summary of the results below.

But first, let's look at why apps collect your data and what they do once they have it.

Why do apps collect your data?

Apps collect your personal data for several reasons. They can use it to improve and update their services or recommend other products that might interest you.In many cases, data collection is essential. Some apps wouldn't work without it. After all, how can Google Maps point you in the right direction if it doesn't know where you are at that moment?

And yes, apps do sell and share your personal data to marketers, research organizations, and cold-calling firms that are borderline scammers.

So is data collection a good thing or a bad thing?

Data collection is like any other tool. It all depends on the intent. Think about a hammer. You can use it to build a house or smash all your neighbor's windows.Many data collection practices are benign. Some are even beneficial.

But data collection still gets a bad rap, and it's easy to see why. Some of the biggest (and most trusted) companies in the world have been caught up in data collection scandals.

During the 2010s, personal data belonging to millions of Facebook users was collected without their consent by British consulting firm Cambridge Analytica. It was predominately used to influence voter behavior in elections and referendums, including the 2016 US presidential race and the UK's Brexit referendum.

Not good (unless you’re the owner of Cambridge Analytica.)

Some of the scandals are even worse, and a few are downright disturbing. Facebook was (once again) busted for using people's data and profile information to see how it could manipulate their emotions.

And there are those rumors. For years, there have been whispers that all the major tech companies have secret deals to give intelligence services access to your data. And it's naive to dismiss this as just another 'conspiracy theory.'

Over 80% of Palantir's (a major data analytics firm) contracts are with US governmental departments, including the CIA and the NSA - who, thanks to whistleblower Edward Snowden, admitted they'd been illegally spying on US citizens for years.

Which apps should you delete first?

You're probably scrolling through your phone, wondering what apps to ditch first. It would take hours - or maybe days - to go through all the privacy statements. And even then, you'd probably give up halfway through. They're not the most exciting reads in the world.Thankfully, OnDeck has done the hard work for you already.

The business apps that collect the most data

If you want to keep your info private, then - surprise, surprise - uninstall Facebook Messenger right now. If you use this communication app to talk with colleagues or arrange lunch meetings, you're giving Facebook unlimited access to 32 segments of personal data. They include location, browsing history, financial info, sensitive info, and even data on your health and wellbeing.Instagram is the next app that has to go. Instagram is great for marketing, but it also has a huge appetite for your data. It collects just as many data segments as Facebook.

PayPal is another big culprit. The finance and accounting business app starts scooping up 26 pieces of data as soon as you download it.

Privacy-focused business people should be wary of content and file management tool Google Drive. It collects your contact info, info on recent purchases, search history, and 15 other personal data segments.

What types of business apps collect the most data?

Marketing is about knowing what people want and when they want it. So it's no shock that marketing apps are the hungriest types of business apps. On average, they collect 16.5 data segments.Finance and accounting apps come next (14 segments), followed by communication apps (11.3), and website and e-commerce apps (9.5 segments.)

At the other end of the scale, business intelligence apps are the least data-hungry apps in the OnDeck study. According to OnDeck’s research, business intelligence apps collect less than 5 (4.5) different pieces of personal data.

Some have rejected data collection altogether

The app for business intelligence and cloud-based services provider MicroStrategy collects zero data from its users. The firm's Privacy Policy statement opens with this reassuring line: "We are not in the business of selling Personal Information about you to advertisers or spammers."

Business apps that respect your privacy

Microstrategy isn’t the only business app that respects its user's privacy.Video conference app Webex Meeting doesn't want your data. Three other business communication apps don't believe in data collection. They are CallRail, Acefone, and 3XC.

Commander One and eFileCabinet might not have the same functionality as Google Drive. But they should be among the first alternatives for business professionals who’ve dumped Google Drive due to privacy concerns. Neither Commander One nor eFileCabinet is interested in a single piece of your private information.

It's time to take back control. See a full breakdown of all the results in the infographics below. Then decide which apps to keep and which apps to delete.

Read next: According to new data your home device might know you better than your family

by Web Desk via Digital Information World

Wednesday, August 31, 2022

Shoppers Don’t Trust Crypto as Small Business Payment Method, Study Finds

As businesses continue recovering from the pandemic's economic consequences, many are promoting the multiple payment methods they offer. Providing more flexibility for consumers encourages a smoother checkout experience. And with so many payment methods being used in the digital space today, many shoppers will prefer some over others. That’s why offering multiple payment options is vital for staying current and keeping people’s business.

Choosing the best payment methods to accept is especially crucial for small businesses. Unfortunately, accepting digital payment methods can significantly cut into their profits. Some companies must charge extra fees at checkout to cover the costs, which might be bad for business. How do small businesses feel about modern payment methods, and are customers willing to pay extra fees to use them? And how do shoppers feel about using cryptocurrency? A new study from Clarify Capital sheds light on the digital era's most popular and trusted payment methods.

The study first explored the most reliable forms of payment according to shoppers and small business owners. Visa and Mastercard were the top two most trusted payment methods, while well-established PayPal ranked third, and newcomer, Zelle, came in last place. The top spots indicated that people still prefer credit cards in the age of digital payments. PayPal’s high ranking is likely due to its brand name recognition, which can play a major part in consumers’ willingness to trust a brand. Some other big brands that have entered the merchant space as viable methods of payment include Apple, Google, and Amazon.

As cryptocurrency continues to rise in popularity, it’s becoming a more common payment method among consumers. While it has its pros and cons, many consider crypto to be a more secure payment method than credit and debit cards. Crypto transactions don’t require third-party verification, and the blockchain general ledger verifies and records each transaction – both of which decrease the possibility of a data breach. On the merchant side, accepting cryptocurrency can reduce transaction fees, and the finality of a crypto payment protects sellers and helps them better manage their cash flow.

While these findings are encouraging, do people feel comfortable using crypto to pay for goods and services? According to the Clarify Capital study, the answer to this question is a resounding “no” – crypto was the least trusted payment method among the consumers surveyed. However, 65% of them also said that businesses offering crypto as a payment method would make them more loyal to that store or brand. It’s an interesting juxtaposition. Whether the hesitancy around cryptocurrency stems from a lack of knowledge or apprehension because of its newness, consumers are having a hard time accepting the concept as part of their daily life.

When it comes to the payment methods that consumers do trust, the big question is whether or not they’re willing to pay more to use them. The study showed that while 60% of small businesses paid fees to offer certain payment platforms, 22% relied on consumers to cover the costs, and 17% split the cost between themselves and their customers.

It’s understandable that most businesses would cover the costs of accepting certain payment methods, considering 34% of respondents would feel negatively toward a company that charged them a fee to process their payment. Despite this finding, some consumers were willing to pay extra to use their payment method of choice: 21% said they’d shell out a little extra to use Amazon Pay, while 20% said they’d do so to use Google Pay.

Consumers have varying payment preferences, but can some payment options actually attract business? Forty-six percent of those surveyed said they’d be most likely to shop at a small business that accepted Visa, while 44% said they’d shop where PayPal was an option. Forty-one percent said Mastercard, 39% said Amazon Pay, and 34% said cryptocurrency – which was significantly more than Venmo (26%), despite its popularity for making digital payments. Perhaps that’s because people more often use Venmo to send and receive money between friends than to pay merchants.

The average amounts spent using newer digital payment methods (ones other than the traditional credit card or cash) varied widely. On average, those who used Google Pay spent $459 per month, while those who used Amazon Pay spent $412. Apple Pay users spent an average of $223 per month, while for those who use PayPal, it was $212. The number dropped to $206 for Venmo and $185 for Cash App. Could there be a reason behind these rates of use?

Beyond brand recognition, the overall experience is what often leads users back to digital apps and platforms, making user experience a key factor for merchants to consider when choosing which payment methods to offer. With so much shopping done online these days, people are used to a quick and streamlined checkout process, so it’s more important than ever to ensure a simple and easy checkout experience. This study revealed some of the pitfalls that might cause businesses to lose sales at this stage.

When study respondents were asked what might cause them to abandon their online shopping cart, 51% said it would be surprise costs and charges, while 48% said they’d most likely be deterred by security concerns. Other top deal breakers were asking for too much information and having to navigate multiple checkout pages. Less concerning were things like an online shop either not being mobile-friendly (29%) or not having an autofill option (20%), but these could still tip the scales for some shoppers. On the flip side, 76% of consumers said that having a one-click payment option would increase their chance of completing a purchase. On average, consumers spend $369 per month through one-click purchases.

The Clarify Capital study indicated that amidst a sea of payment options, Americans still seem to prefer their Visas and Mastercards. While digital payment methods are certainly the way of the future, there’s still a long way to go before consumers widely trust some of the newer payment platforms. Still, small businesses would benefit from offering multiple options as long as they don’t burden their customers with extra fees. And while most consumers aren’t quite ready to do their shopping with crypto, small businesses will also want to consider accepting this increasingly common form of currency at some point. As long as it’s easy to use, it's only a matter of time before people become more amenable to using crypto and other digital payment methods.

Read next: Digital Marketers Received a 23% Pay Bump in 3 Years

by Web Desk via Digital Information World

Choosing the best payment methods to accept is especially crucial for small businesses. Unfortunately, accepting digital payment methods can significantly cut into their profits. Some companies must charge extra fees at checkout to cover the costs, which might be bad for business. How do small businesses feel about modern payment methods, and are customers willing to pay extra fees to use them? And how do shoppers feel about using cryptocurrency? A new study from Clarify Capital sheds light on the digital era's most popular and trusted payment methods.

The study first explored the most reliable forms of payment according to shoppers and small business owners. Visa and Mastercard were the top two most trusted payment methods, while well-established PayPal ranked third, and newcomer, Zelle, came in last place. The top spots indicated that people still prefer credit cards in the age of digital payments. PayPal’s high ranking is likely due to its brand name recognition, which can play a major part in consumers’ willingness to trust a brand. Some other big brands that have entered the merchant space as viable methods of payment include Apple, Google, and Amazon.

As cryptocurrency continues to rise in popularity, it’s becoming a more common payment method among consumers. While it has its pros and cons, many consider crypto to be a more secure payment method than credit and debit cards. Crypto transactions don’t require third-party verification, and the blockchain general ledger verifies and records each transaction – both of which decrease the possibility of a data breach. On the merchant side, accepting cryptocurrency can reduce transaction fees, and the finality of a crypto payment protects sellers and helps them better manage their cash flow.

While these findings are encouraging, do people feel comfortable using crypto to pay for goods and services? According to the Clarify Capital study, the answer to this question is a resounding “no” – crypto was the least trusted payment method among the consumers surveyed. However, 65% of them also said that businesses offering crypto as a payment method would make them more loyal to that store or brand. It’s an interesting juxtaposition. Whether the hesitancy around cryptocurrency stems from a lack of knowledge or apprehension because of its newness, consumers are having a hard time accepting the concept as part of their daily life.

When it comes to the payment methods that consumers do trust, the big question is whether or not they’re willing to pay more to use them. The study showed that while 60% of small businesses paid fees to offer certain payment platforms, 22% relied on consumers to cover the costs, and 17% split the cost between themselves and their customers.

It’s understandable that most businesses would cover the costs of accepting certain payment methods, considering 34% of respondents would feel negatively toward a company that charged them a fee to process their payment. Despite this finding, some consumers were willing to pay extra to use their payment method of choice: 21% said they’d shell out a little extra to use Amazon Pay, while 20% said they’d do so to use Google Pay.

Consumers have varying payment preferences, but can some payment options actually attract business? Forty-six percent of those surveyed said they’d be most likely to shop at a small business that accepted Visa, while 44% said they’d shop where PayPal was an option. Forty-one percent said Mastercard, 39% said Amazon Pay, and 34% said cryptocurrency – which was significantly more than Venmo (26%), despite its popularity for making digital payments. Perhaps that’s because people more often use Venmo to send and receive money between friends than to pay merchants.

The average amounts spent using newer digital payment methods (ones other than the traditional credit card or cash) varied widely. On average, those who used Google Pay spent $459 per month, while those who used Amazon Pay spent $412. Apple Pay users spent an average of $223 per month, while for those who use PayPal, it was $212. The number dropped to $206 for Venmo and $185 for Cash App. Could there be a reason behind these rates of use?

Beyond brand recognition, the overall experience is what often leads users back to digital apps and platforms, making user experience a key factor for merchants to consider when choosing which payment methods to offer. With so much shopping done online these days, people are used to a quick and streamlined checkout process, so it’s more important than ever to ensure a simple and easy checkout experience. This study revealed some of the pitfalls that might cause businesses to lose sales at this stage.

When study respondents were asked what might cause them to abandon their online shopping cart, 51% said it would be surprise costs and charges, while 48% said they’d most likely be deterred by security concerns. Other top deal breakers were asking for too much information and having to navigate multiple checkout pages. Less concerning were things like an online shop either not being mobile-friendly (29%) or not having an autofill option (20%), but these could still tip the scales for some shoppers. On the flip side, 76% of consumers said that having a one-click payment option would increase their chance of completing a purchase. On average, consumers spend $369 per month through one-click purchases.

The Clarify Capital study indicated that amidst a sea of payment options, Americans still seem to prefer their Visas and Mastercards. While digital payment methods are certainly the way of the future, there’s still a long way to go before consumers widely trust some of the newer payment platforms. Still, small businesses would benefit from offering multiple options as long as they don’t burden their customers with extra fees. And while most consumers aren’t quite ready to do their shopping with crypto, small businesses will also want to consider accepting this increasingly common form of currency at some point. As long as it’s easy to use, it's only a matter of time before people become more amenable to using crypto and other digital payment methods.

Read next: Digital Marketers Received a 23% Pay Bump in 3 Years

by Web Desk via Digital Information World

Google Search Tests Out New Label for Short Articles

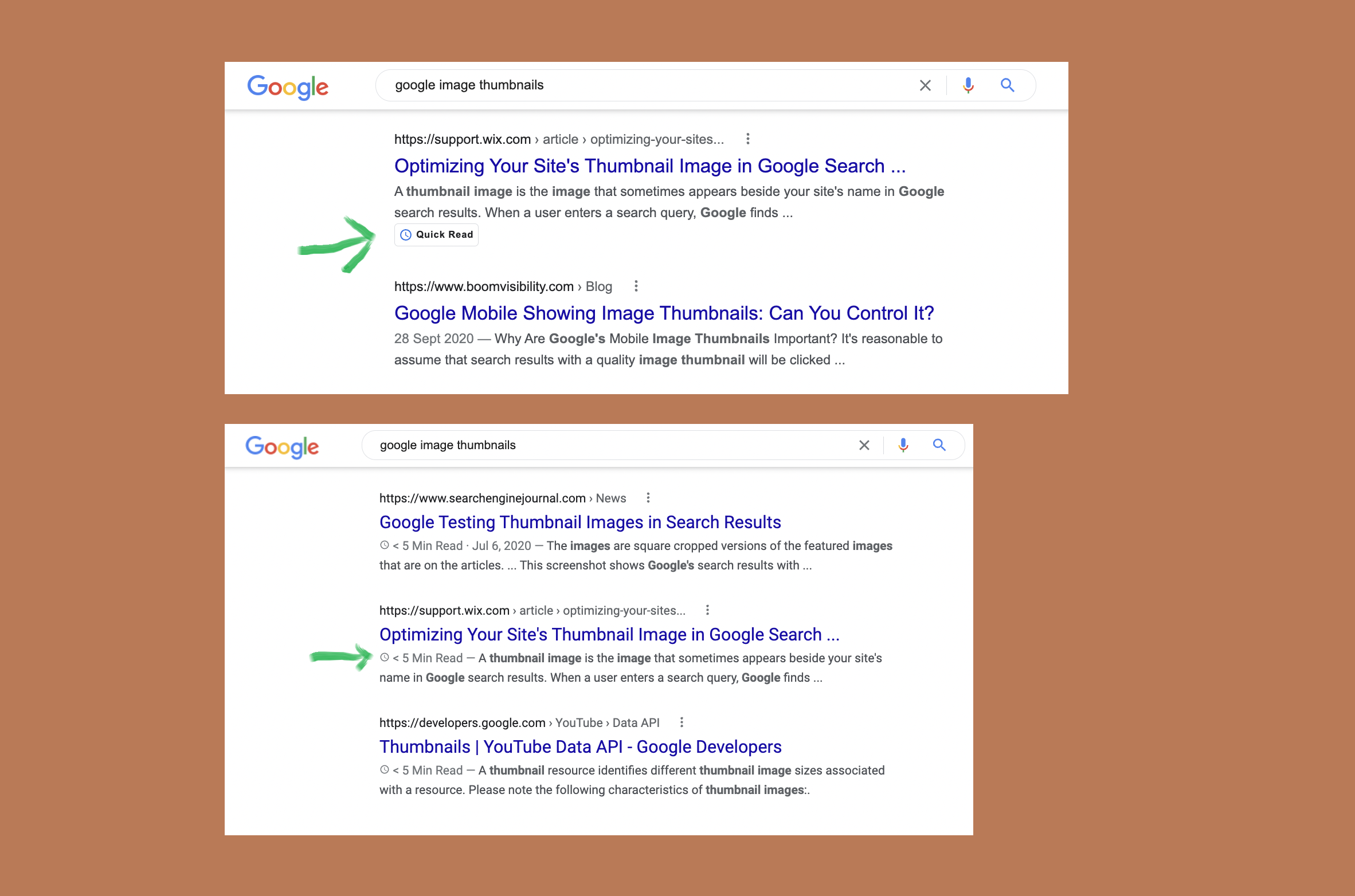

Many users who are entering keywords into Google’s powerful search engine want to find short articles because of the fact that this is the sort of thing that could potentially end up allowing them to digest all of the required information in the shortest amount of time possible. Google is well aware of that, which is why the search engine giant is experimenting with a new label that can earmark short reads for its users, spotted by Brodieclark.

This new label is called “Quick Read”, and with all of that having been said and now out of the way it is important to note that only some users have mentioned seeing it in their Google SERP. The purpose of this label is to indicate to users that an article can be read in under 5 minutes. Some users also noted different version of the label, including one such as “<5 Min Read”, so Google is clearly trying a few things out to see what sticks once all has been said and is now out of the way.

While there is no way of knowing whether or not this feature would be part of Google’s next update, if it gets rolled out we might see an even greater wave of short form content. Short form content is already taking the internet by storm, and the prospect of receiving a label that would draw user attention would sweeten the deal further with all things having been considered and taken into account.

We might start seeing a lot more short form content, and Google has been giving this type of content higher rankings on its SERP for quite some time now. One thing to note here is that this test has been conducted both for web users as well as mobile users which makes it more likely that the beta test would turn into a permanent feature.

It will be interesting to see how this feature changes the landscape of SEO, as well as the content industry in general. Google is a powerful force within the world of the internet, so this change could be quite influential.

Read next: New Warning For Malware Campaign Disguised As Google Translate On The Rise

by Zia Muhammad via Digital Information World

This new label is called “Quick Read”, and with all of that having been said and now out of the way it is important to note that only some users have mentioned seeing it in their Google SERP. The purpose of this label is to indicate to users that an article can be read in under 5 minutes. Some users also noted different version of the label, including one such as “<5 Min Read”, so Google is clearly trying a few things out to see what sticks once all has been said and is now out of the way.

While there is no way of knowing whether or not this feature would be part of Google’s next update, if it gets rolled out we might see an even greater wave of short form content. Short form content is already taking the internet by storm, and the prospect of receiving a label that would draw user attention would sweeten the deal further with all things having been considered and taken into account.

We might start seeing a lot more short form content, and Google has been giving this type of content higher rankings on its SERP for quite some time now. One thing to note here is that this test has been conducted both for web users as well as mobile users which makes it more likely that the beta test would turn into a permanent feature.

It will be interesting to see how this feature changes the landscape of SEO, as well as the content industry in general. Google is a powerful force within the world of the internet, so this change could be quite influential.

Read next: New Warning For Malware Campaign Disguised As Google Translate On The Rise

by Zia Muhammad via Digital Information World

Subscribe to:

Comments (Atom)